US Listed and Delisted Stocks Now Available

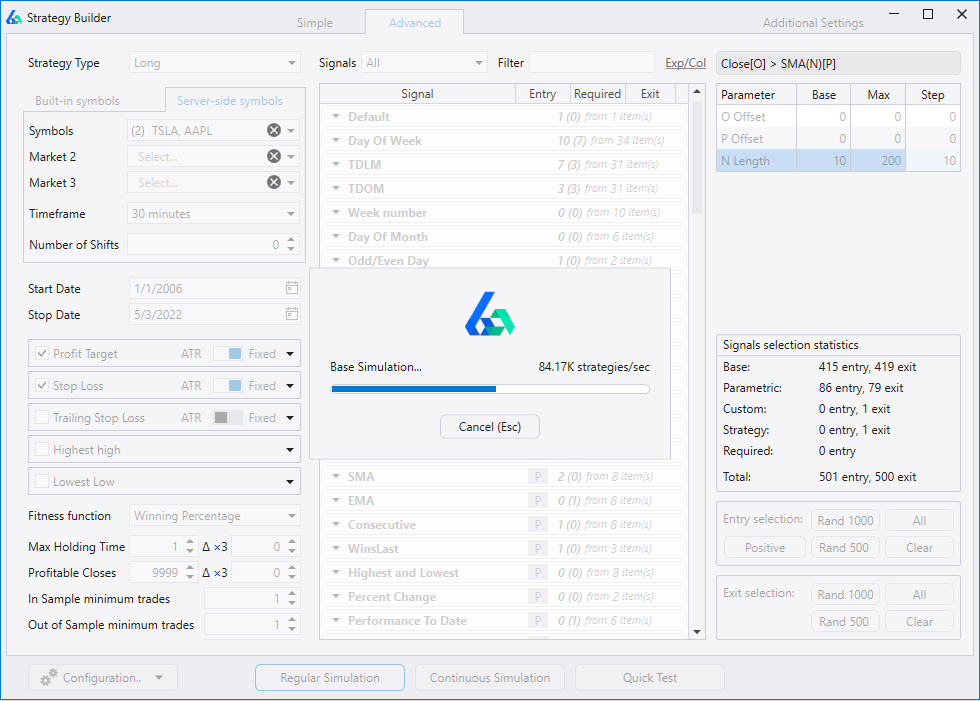

Currently, Build Alpha offers over 7,000 pre-built entry signals. Includes all open, high, low, close combinations over the past 10 bars, most major technical indicators and oscillators such as: MACD, RSI, Stochastics, ATR, Kaufman Efficiency Ratio, Hurst Exponent, DMI, Moving Averages, Composite Indicators, etc. Build Alpha also includes candlesticks, volume analysis, consecutive OHLC (open,high,low,close) conditions, seasonality, holidays and much more including secondary data signals such as the VIX, VIX Term Structure and Treasury yields and spreads.

Build Alpha allows Inter Market signals. That is, you can now create and improve systems for your primary market by taking into account signals generated from a secondary and tertiary market. For example, create an S&P500 system that improves when Gold has above average volume and US Bonds are below their 200 day moving average. Build Alpha also offers multi-timeframe signals. That is, trade the 30 minute chart only when the daily chart confirms.

All built-in signals in Build Alpha are editable by the trader/money manager. Start with the built-in signals, modify them or have Build Alpha modify them.

Other signals included are market breadth signals, economic news and data, Dark Pool Index (DIX), Gamma Exposure (GEX) and term structure signals.

Build Alpha also has a custom rule/indicator builder. So if you want to test a custom idea or set of rules you can now create and save thousands of custom signals to run through the software in order to find strategies in combination with the pre-built signal choices.

Finally, Build Alpha has a fully capable python environment. Want to write your own indicators/rules to test? You can now use python, if desired.

A few of the exit possibilities are maximum holding time, volatility based profit targets and stop losses, trailing stops, profitable closes, highest high over a lookback period and lowest low over a lookback period. Any of the exit specific rules (such as stop loss) can be combined with any/all of the exit signals (RSI or Price Action, e.g.).

All of these exit combinations can be turned off/on and adjusted. This freedom allows the trader or money manager to find the best strategies to fit his/her personal risk/reward specifications.

In short, the trader or money manager will select one of these fitness functions while setting up the input interface. Build Alpha will create possible strategies trying to optimize this fitness function. For example, the trader or money manager selects Sharpe Ratio then Build Alpha will find strategies with the selected entry signals and exit criteria that have the highest Sharpe Ratio. The same search (entry and exits) can be run again but this time finding strategies that have the higher net profit to drawdown (after changing the fitness function).

Theoretically, the user could select 30% out of sample and fail to set a minimum number of trades for out of sample trading. In this example, the trader could find a strategy that rarely traded during the out of sample period due to a regime change or some other factor.

The Build Alpha software allows the trader or money manager the ability to prevent this type of behavior or allow it (as it may be useful to find a strategy that is quiet during a certain regime).

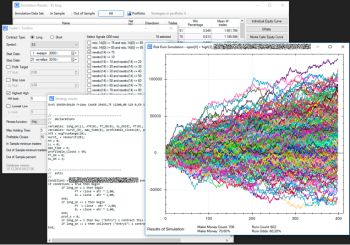

Build Alpha also allows the trader/money manager to view how the strategies generated compare to random strategies created using both random signals and randomly generated data. This helps lower the probabilities that strategies found are “curve-fit” by allowing the user to compare that the strategies found perform significantly better than what could have been found by random signals or random data.

The Output Interface also has measures to prevent data mining bias, curve fitting, and ultimately resulting in the production of seemingly robust trading strategies.

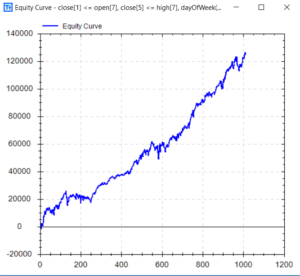

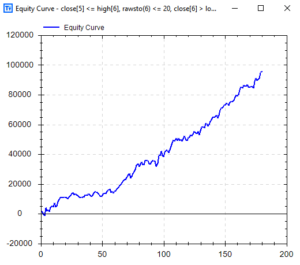

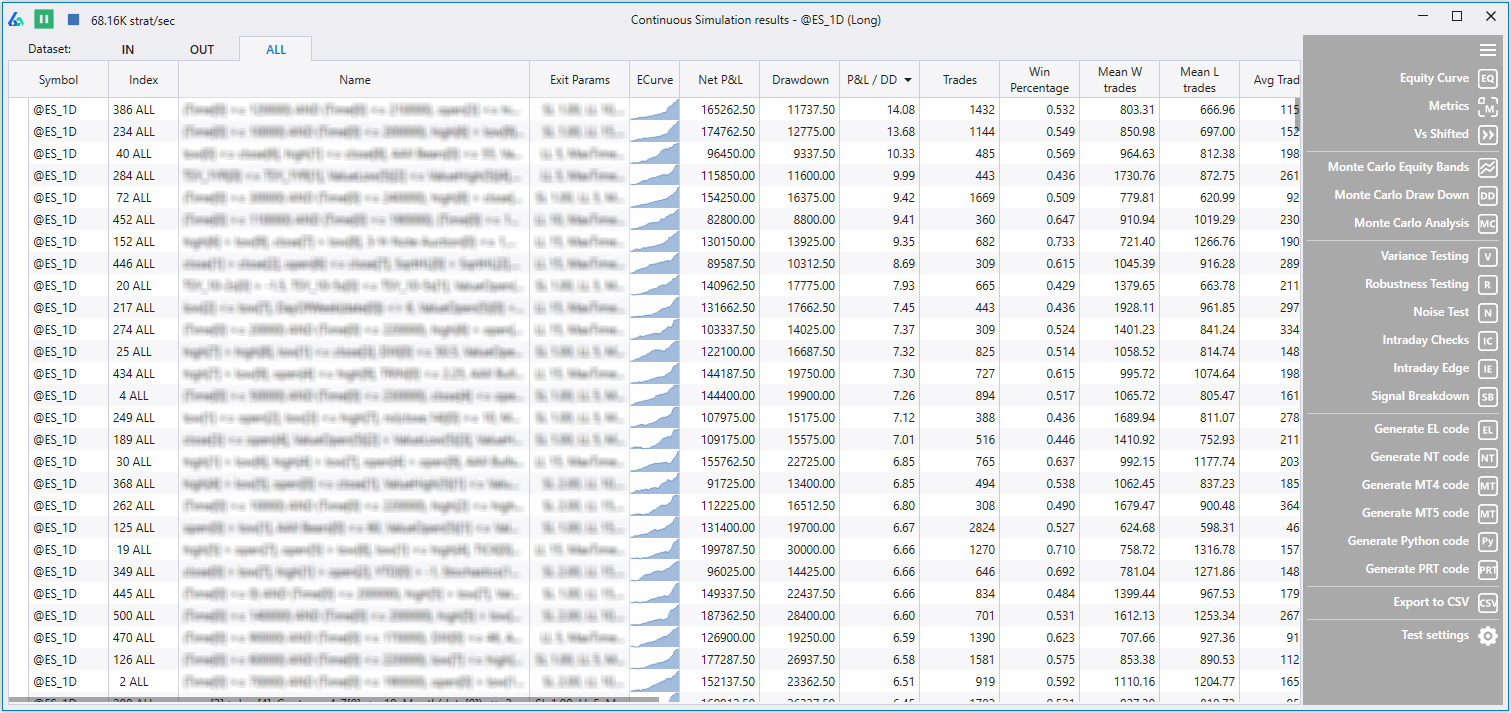

This interface displays each strategy found, the signals used, its performance criteria such as: profit factor, winning percentage, net p&l, drawdown, number of trades, Sharpe ratio, etc. all in a sortable table.

The Output Interface also allows to view the test results for each period. That is, the trader or money manager can see how a strategy performed in sample, out of sample, and combined.

The Output Interface also allows the visualization of each and every strategy Build Alpha found. The trader money manager can view equity curves(cumulative p&l), edge ratios, Monte Carlo projections, Monte Carlo drawdown analysis, and our own variance testing for how we simulate future trading is likely to proceed for the given strategy.

To see visuals please visit this link: http://staging.buildalpha.com/features/

Additionally, each and every strategy can be added to a portfolio for portfolio evaluation.

Finally, each and every strategy can generate automatable, ready to trade code for TradeStation’s EasyLanguage, MultiChart’s Power Language, and NinjaTrader’s C# code with the click of a button.

Run our variance test to see where we simulate performance to be n days into the future.

Also, at the click of a button, generate fully automatable/ready to trade TradeStation EasyLanguage, MultiChart PowerLanguage, or NinjaTrader C# code for entire portfolio or combination of strategies.

The correlation matrix uses marked to market daily returns. This allows us to analyze strategies that trade at different frequencies and have different holding periods.

This unique tool gives traders and money managers an advantage over traditional position sizing approaches.