The Goal of Intraday Trading

A large consideration of developing trading systems should be how efficient our capital is working for us. The quicker we can realize profits, the more trades we can make thus allowing our capital to compound more quickly. Additionally, sitting in positions for long periods increases our risk to extraneous events.

On the other hand, it is typically easier to find daily or higher timeframe edges than intraday edges due to the increased noise in intraday data.

From Daily to Intraday?

Is there a way to reduce the time in a position which would increase our trade count (via number of strategies) which would then allow us to arrive at the law of large numbers more quickly and therefore allow our capital to compound more quickly?

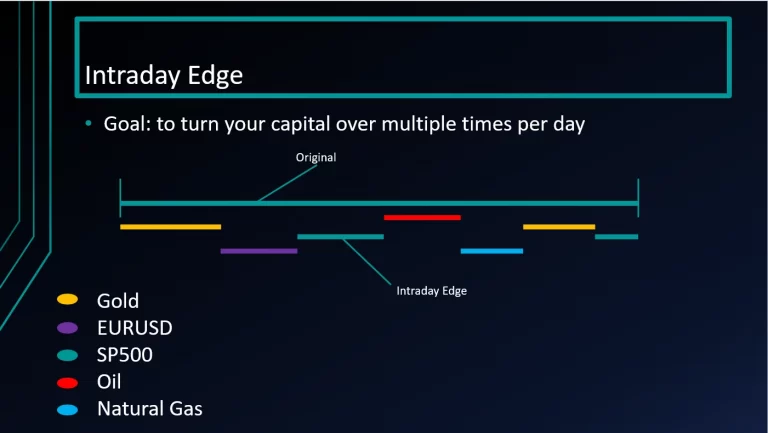

Yep. One of the new features in Build Alpha, called “Intraday Edge”, is a tool which allows us to do exactly that. Intraday Edge allows us to dig deeper into daily trading strategies to see if we can make them more efficient by reducing their holding times into smaller intraday time windows.

Maybe we can capture most of the daily strategy’s edge during only a small portion of the typical holding time. That’s right.. turning daily strategies into intraday strategies.

Intraday Edge Trading Example

First, let’s take an original daily trading system to examine the power of this new feature. I will use a simple one rule strategy that:

- SP500 Futures Contract

- Long Only

- Buy when close in bottom 20% of day’s range (IBR or internal bar strength in Build Alpha)

- Exit 1 day later

This assumes about a 23 hour risk (i.e., one Globex trading session).

Intraday Improvement

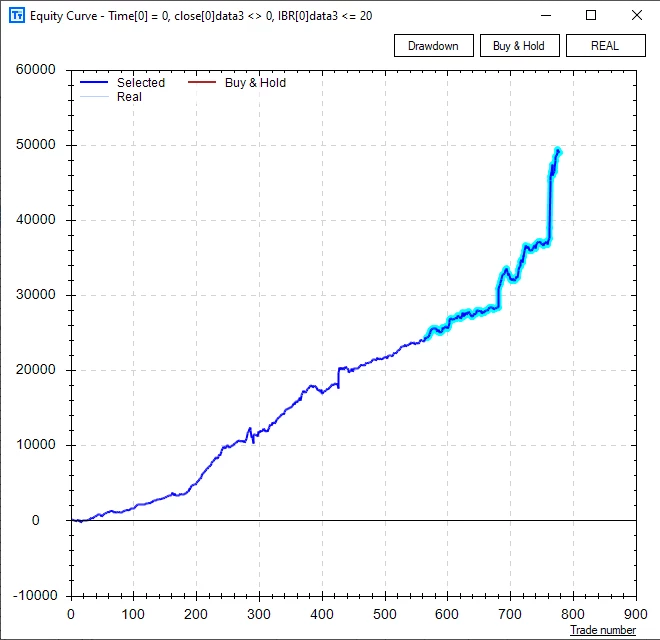

However, what if we could dig into this strategy and realize that most of the gains only come from 1 am EST to 4 am EST? We can then reduce our holding time by about 87% which now only ties up our capital for 3 hours as opposed to 23! This gives us an additional 20 hours to utilize other strategies to continue to grow our capital while still capturing a large portion of the original daily strategy’s edge.

Imagine we only had enough capital for one strategy. This Intraday Edge feature can now make our capital work much harder by finding intraday edge strategies for multiple markets/times of the day. Tying up capital for 23 hours in one daily strategy vs. trading 7 different intraday edge strategies with the same capital.

*Original strategy can be reduced by Intraday Edge which allows other intraday strategies to be traded with the same capital that was orignially tied up by the daily strategy*

In the end, it makes our once daily system much more efficient. Check out the performance metrics of the original daily system compared to the new “Intraday Edge” version.

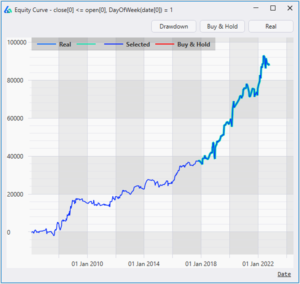

*Daily Strategy*

*Intraday Edge*

In the end, it makes our once daily system much more efficient. Check out the performance metrics of the original daily system compared to the new “Intraday Edge” version.

Steps in Build Alpha

So how can this be accomplished in Build Alpha? It is simple.

- 1. Highlight any daily strategy

- 2. Click the Test Settings in the bottom right to configure the intraday timeframe you want to use

- 3. Hit the Intraday Edge button

Build Alpha will then search all possible holding periods within the original strategy’s trading duration to see if there is a more efficient version with reduced holding times. You can include the original strategy’s exit criteria such as stops, etc. or choose to exclude them. Flexibility to test everything is always key in Build Alpha.

Additional Uses of Intraday Edge Feature

Intraday Edge can even be used on different markets at the same time. For example, imagine an original system built on Gold daily bars but then we search for an intraday edge version that trades oil but only during this specific 2 hour window while the original Gold System has an active signal.

This Intraday Edge feature essentially allows us to search for intraday and multi-timeframe strategies in a new way. In this above Gold and Oil example we have a multi-timeframe AND intermarket strategy created from a simple Gold daily strategy.

You can still search for multi-timeframe and intraday strategies in the original/traditional way. That is, just searching the intraday data from the start. However, it is often faster and easier to find daily strategies then work them into intraday ones. At least now with Build Alpha you have the option to search both ways. Something not possible elsewhere.

Automating Intraday Edge Trading Strategies

And of course, all of the adjustments from the Intraday Edge feature are then applied to the code generators so you can automate these Intraday Edge systems with one click as with everything.

As always, I will keep attempting to add flexibility and ways to dig deeper so we can have the best trading strategies possible. Leave no stone unturned and test everything!

Thanks for reading,

Author

David Bergstrom – the guy behind Build Alpha. I have spent a decade-plus in the professional trading world working as a market maker and quantitative strategy developer at a high frequency trading firm with a Chicago Mercantile Exchange (CME) seat, consulting for Hedge Funds, Commodity Trading Advisors (CTAs), Family Offices and Registered Investment Advisors (RIAs). I am a self-taught programmer utilizing C++, C# and python with a statistics background specializing in data science, machine learning and trading strategy development. I have been featured on Chatwithtraders.com, Bettersystemtrader.com, Desiretotrade.com, Quantocracy, Traderlife.com, Seeitmarket.com, Benzinga, TradeStation, NinjaTrader and more. Most of my experience has led me to a series of repeatable processes to find, create, test and implement algorithmic trading ideas in a robust manner. Build Alpha is the culmination of this process from start to finish. Please reach out to me directly at any time.